Experiencing a disaster such as a fire not only impacts your emotional and physical well-being but can also significantly affect your financial stability. The road to recovery involves not just rebuilding your home but also reestablishing your financial footing. Effective financial planning after a disaster is crucial to securing your future and easing the transition back to normalcy. This guide provides steps to help you navigate the financial challenges that may arise following a catastrophic event.

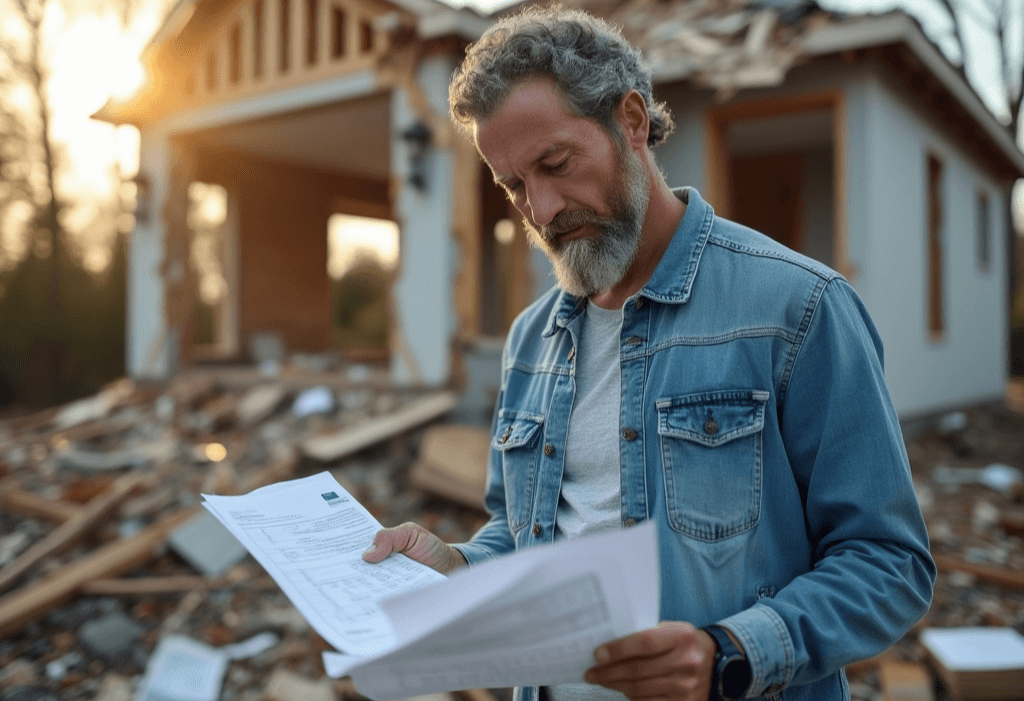

Assess Your Current Financial Situation

The first step in financial planning after a disaster is to take stock of your current financial status. Gather all pertinent financial documents, such as bank statements, investment portfolios, insurance policies, tax records, and any documents related to loans or debts. If physical documents were lost in the disaster, reach out to your financial institutions for copies.

Understanding your income, expenses, assets, and liabilities will give you a clear picture of where you stand. This assessment should include any immediate expenses related to the disaster, such as temporary housing, medical bills, or emergency repairs.

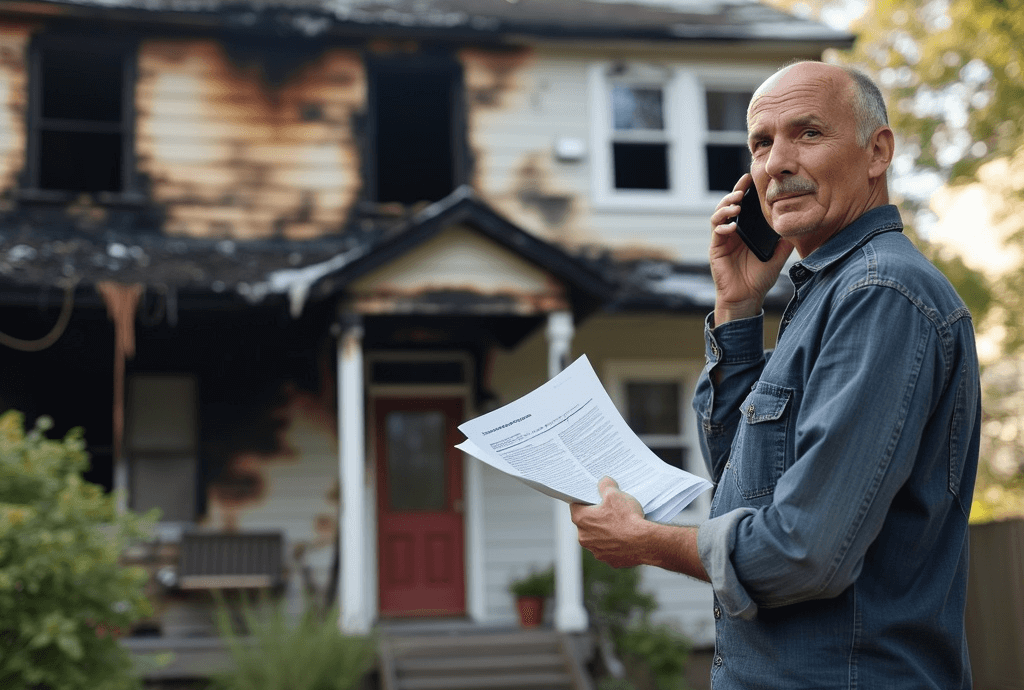

File Insurance Claims Promptly

Contact your insurance company as soon as possible to initiate the claims process. Provide detailed information about the damage and losses incurred. Documentation is key—take photographs, make lists of damaged items, and keep receipts for any expenses related to the disaster.

Understanding the specifics of your insurance coverage is essential. Policies may vary in terms of what is covered, deductibles, and the timeframe for filing claims. If necessary, don’t hesitate to seek clarification from your insurance agent to ensure you’re maximizing your benefits.

Explore Disaster Assistance Programs

In the aftermath of widespread disasters, government agencies like the Federal Emergency Management Agency (FEMA) offer assistance programs to help affected individuals and businesses. These programs can provide grants for temporary housing, home repairs, and other critical needs.

Visit the official FEMA website or DisasterAssistance.gov to determine your eligibility and apply for aid. Additionally, local and state agencies, as well as non-profit organizations like the Red Cross, may offer resources and support. Taking advantage of these programs can alleviate some of the financial burdens during this challenging time.

Communicate with Creditors and Service Providers

Proactively reach out to your mortgage lender, credit card companies, utilities, and other service providers to inform them of your situation. Many creditors have disaster relief policies that may include payment deferments, waived late fees, or modified payment plans.

Open communication can prevent negative marks on your credit report and provide some breathing room as you work to stabilize your finances. Be sure to document all communications and get any agreed-upon arrangements in writing.

Create a Revised Budget

Adjusting your budget to reflect your new circumstances is crucial. Your income and expenses may have changed dramatically, so it’s important to prioritize essential expenses such as housing, food, healthcare, and transportation.

Identify areas where you can reduce spending and redirect funds toward immediate needs and rebuilding efforts. A revised budget serves as a financial roadmap, helping you make informed decisions and avoid unnecessary debt.

Consider Short-Term Financial Assistance

If you find yourself in need of immediate funds, consider options such as personal loans, lines of credit, or credit card advances. However, exercise caution with high-interest debts that can create long-term financial strain.

Alternatively, explore community resources or emergency hardship funds that may be available through local organizations, employers, or religious institutions. These resources may offer low-interest loans or grants to individuals recovering from disasters.

Protect Your Credit Score

Maintaining a good credit score is important for your long-term financial health. Monitor your credit reports for any inaccuracies or signs of identity theft, which can sometimes occur after a disaster when personal information may be compromised.

You are entitled to free credit reports from the three major credit bureaus—Equifax, Experian, and TransUnion—once a year through AnnualCreditReport.com. Review these reports carefully and dispute any errors promptly.

Plan for Future Financial Security

As you begin to rebuild, consider ways to strengthen your financial resilience against future disasters. This may include:

Emergency Savings Fund: Aim to build or rebuild an emergency fund that covers at least three to six months of living expenses.

Insurance Review: Evaluate your insurance coverage to ensure it adequately protects your home, possessions, and income. Consider additional coverage such as flood or earthquake insurance if appropriate for your area.

Estate Planning: Update or create estate planning documents like wills, trusts, and powers of attorney to protect your assets and provide for your loved ones.

Seek Professional Financial Advice

Navigating the financial complexities after a disaster can be overwhelming. Consulting with a financial advisor or counselor can provide personalized guidance tailored to your situation. They can assist with budgeting, investment strategies, debt management, and retirement planning.

Non-profit credit counseling agencies offer free or low-cost services to help you regain financial stability. Be sure to choose a reputable organization accredited by agencies like the National Foundation for Credit Counseling (NFCC).

Take Care of Your Emotional Well-Being

Financial stress can take a toll on your mental health. It’s important to address the emotional impact of the disaster alongside the financial aspects. Seek support from friends, family, or professional counselors to help cope with stress, anxiety, or depression.

Taking care of your emotional well-being will empower you to make clearer financial decisions and provide the strength needed to navigate the recovery process.

Conclusion

Recovering financially after a disaster is a challenging journey that requires careful planning, resourcefulness, and resilience. By taking proactive steps to assess your situation, leveraging available resources, and seeking professional guidance, you can rebuild a secure financial foundation.

At Hope Street Partners, we understand the multifaceted challenges that disasters bring. Our team is committed to supporting you not just in rebuilding your home but also in restoring your financial well-being. Explore our services to learn how we can assist you in securing a stable and prosperous future.